SeleneAlgo

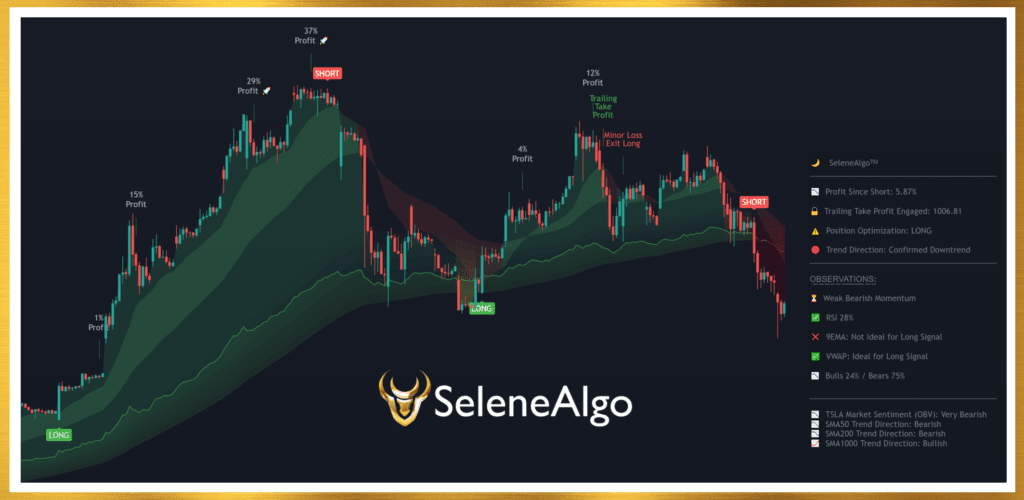

SeleneAlgo identifies entry and exit positions by combining momentum and multiple fast moving averages with custom candle analysis & price action, in addition to several other factors. By doing so, SeleneAlgo can identify confident long/short signals as soon as the market trend changes while filtering out many false positives.

All these features combined with an extremely informative Dashboard creates a powerful tool that can be customized according to the user’s trading style and comfort level.

Trading Just Got Easier

Unprecedented Market Insight

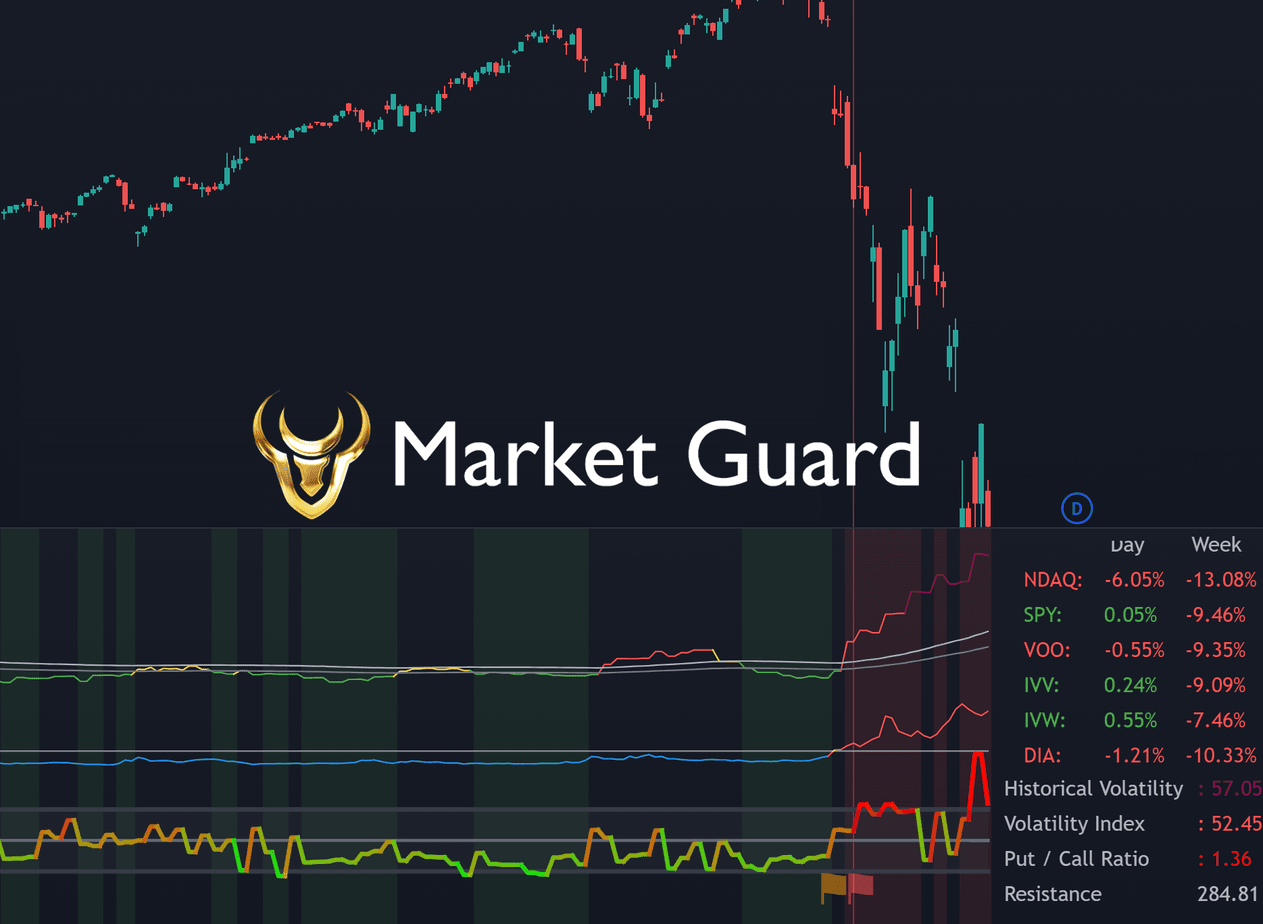

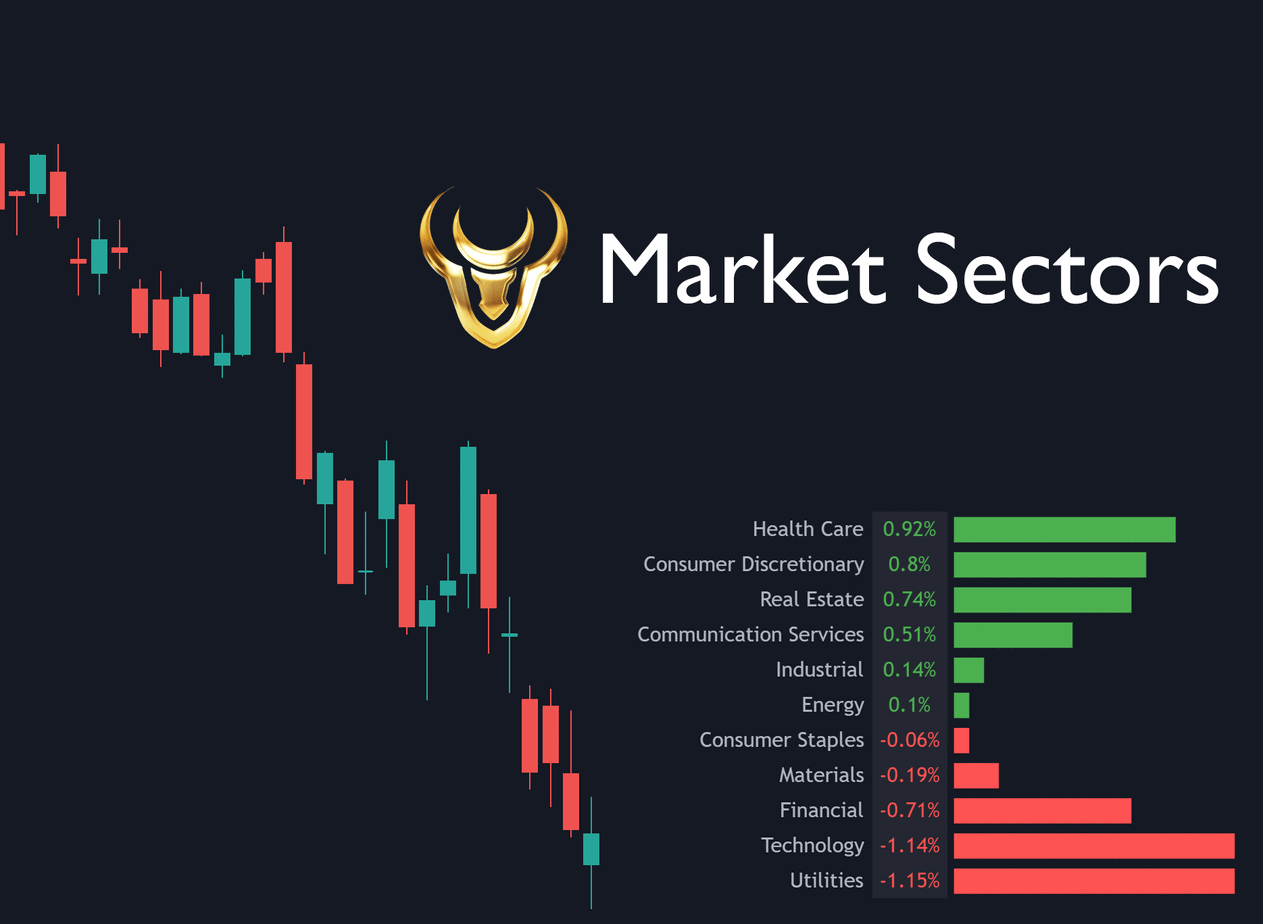

Market Guard

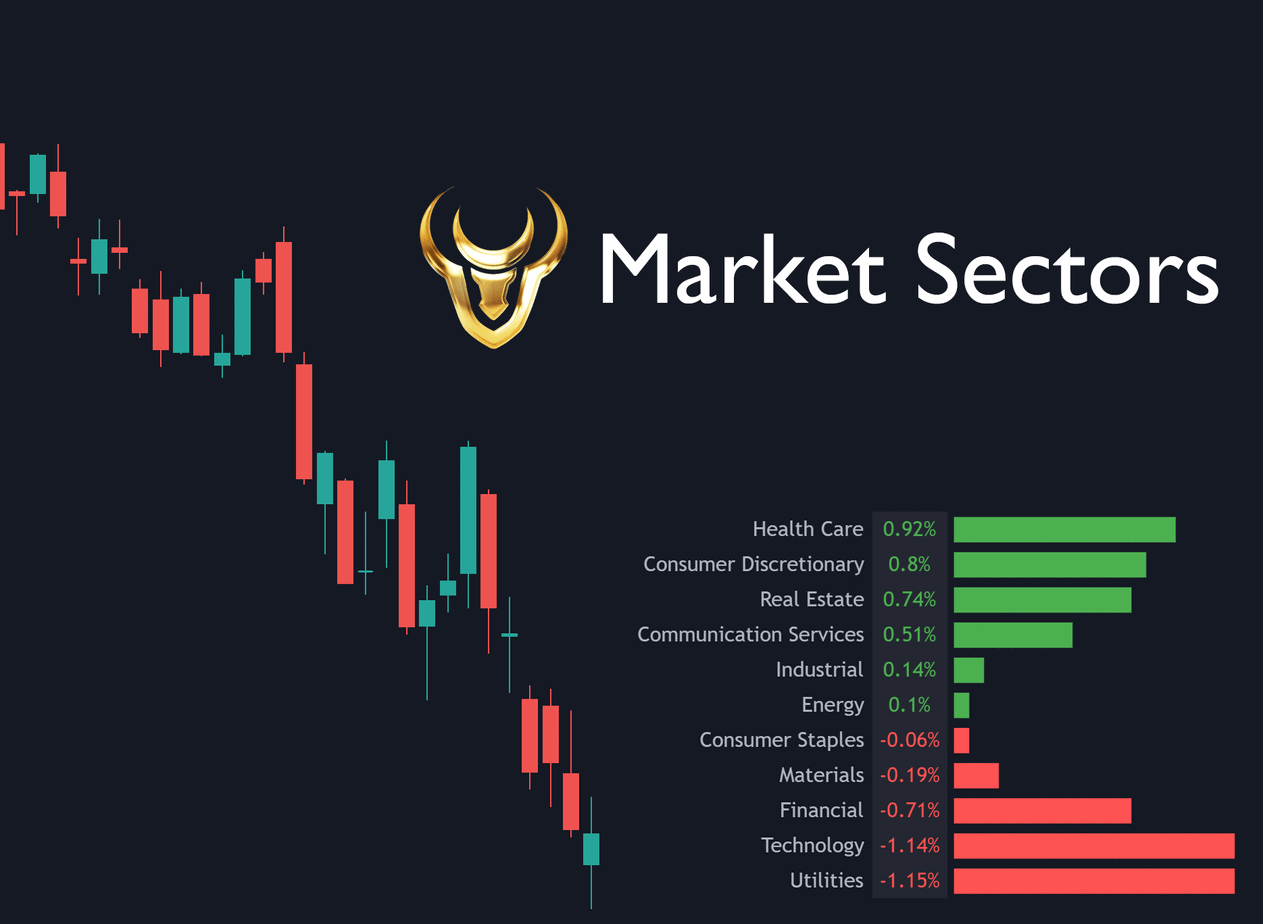

Market Guard interprets sentiment direction, inflation, interest, yield spreads, and volatility patterns of the overall stock market. In doing so, we can see extremely early warning signs when the market is the verge of a potential market crash or bear market, in addition to signs of market recovery.

Case Study of past results in relation to historical large stock market crashes can be found here

.

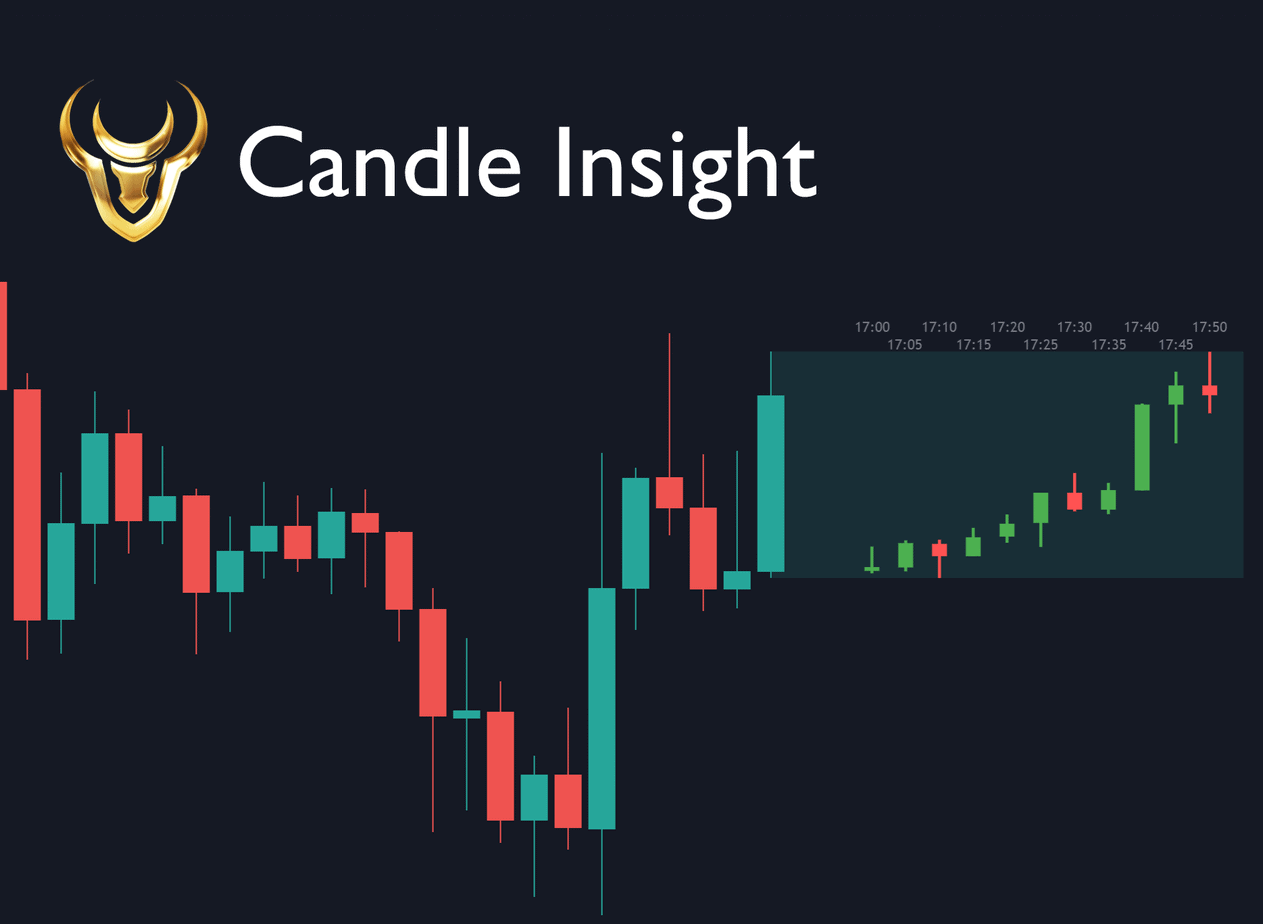

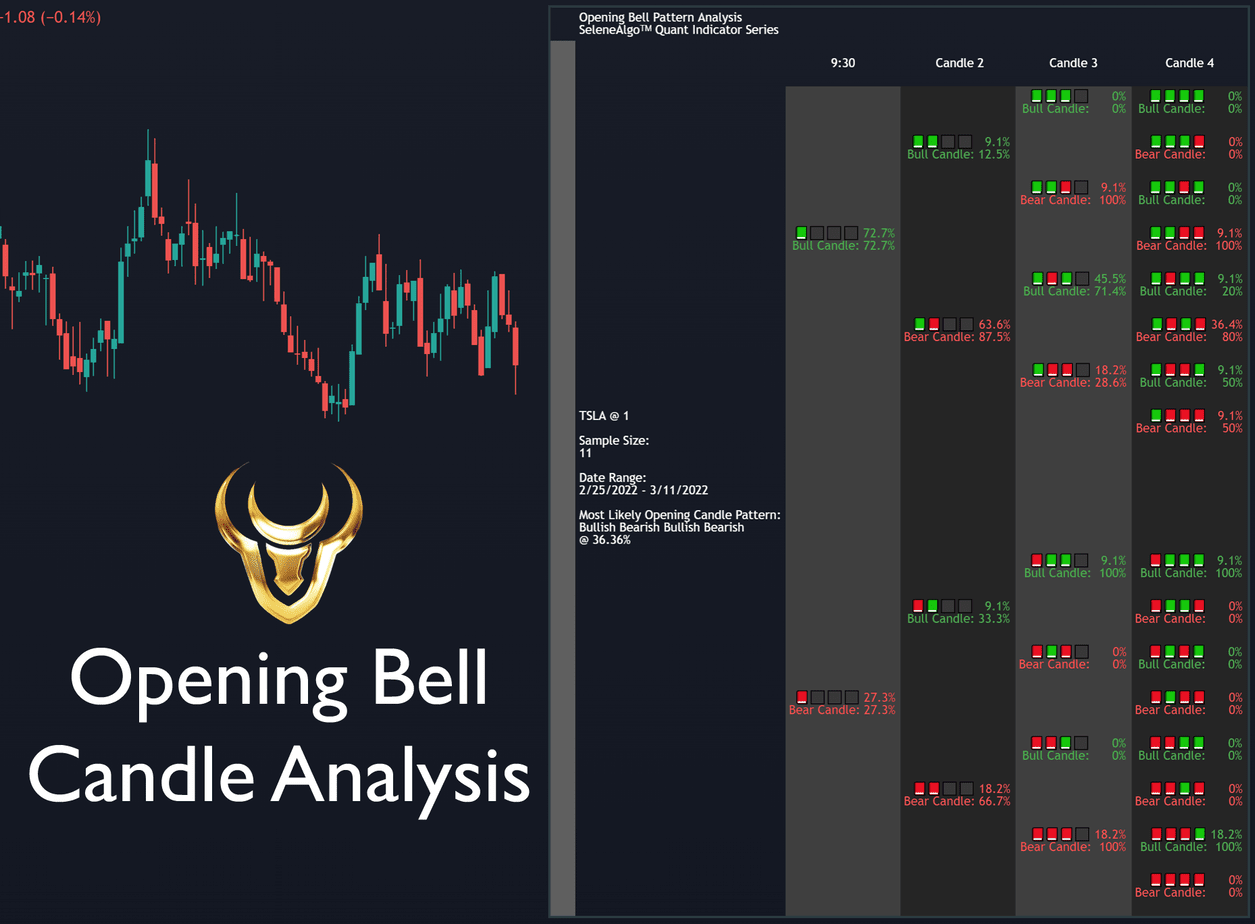

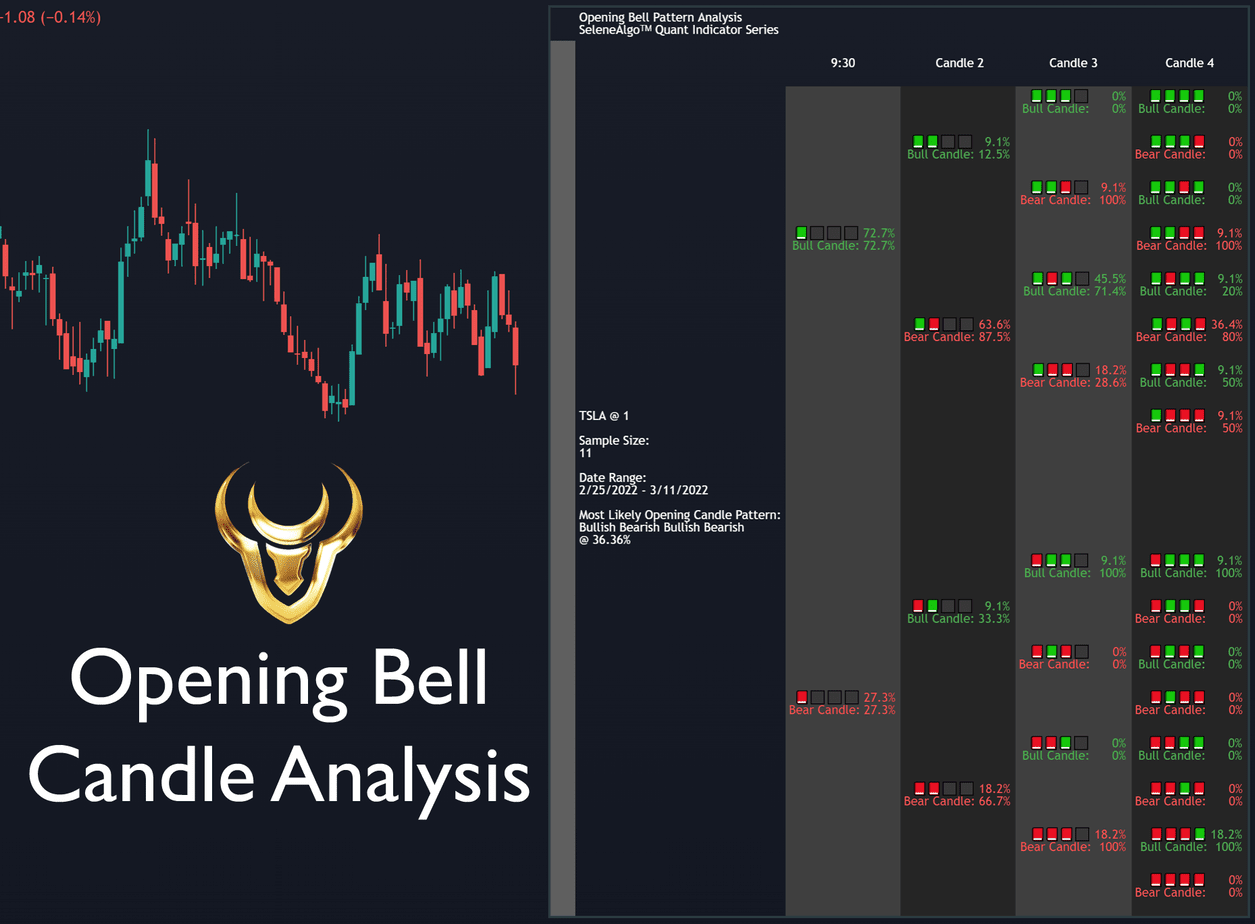

Opening Bell Candle Analysis

Opening Bell Candle Analysis analyzes the statistical probability of candle behavior patterns starting from an inputted time allowing the trader to see the exact % chance of what the next candle will be based on its history. This allows a trader to look at a security they are unfamiliar with for the first time and instantly see if it tends to demonstrate a reoccurring pattern of market opening candles or at a specific given time of day.

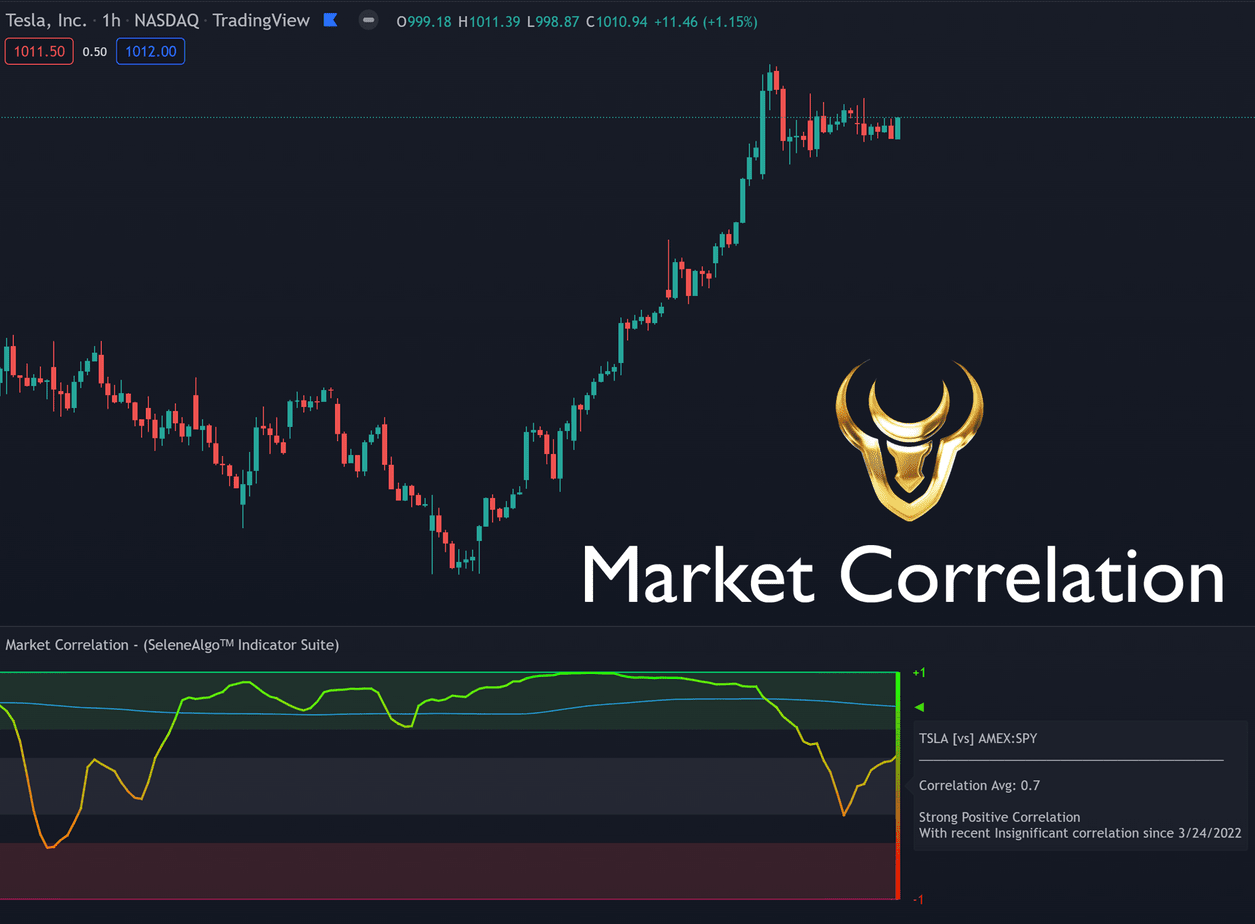

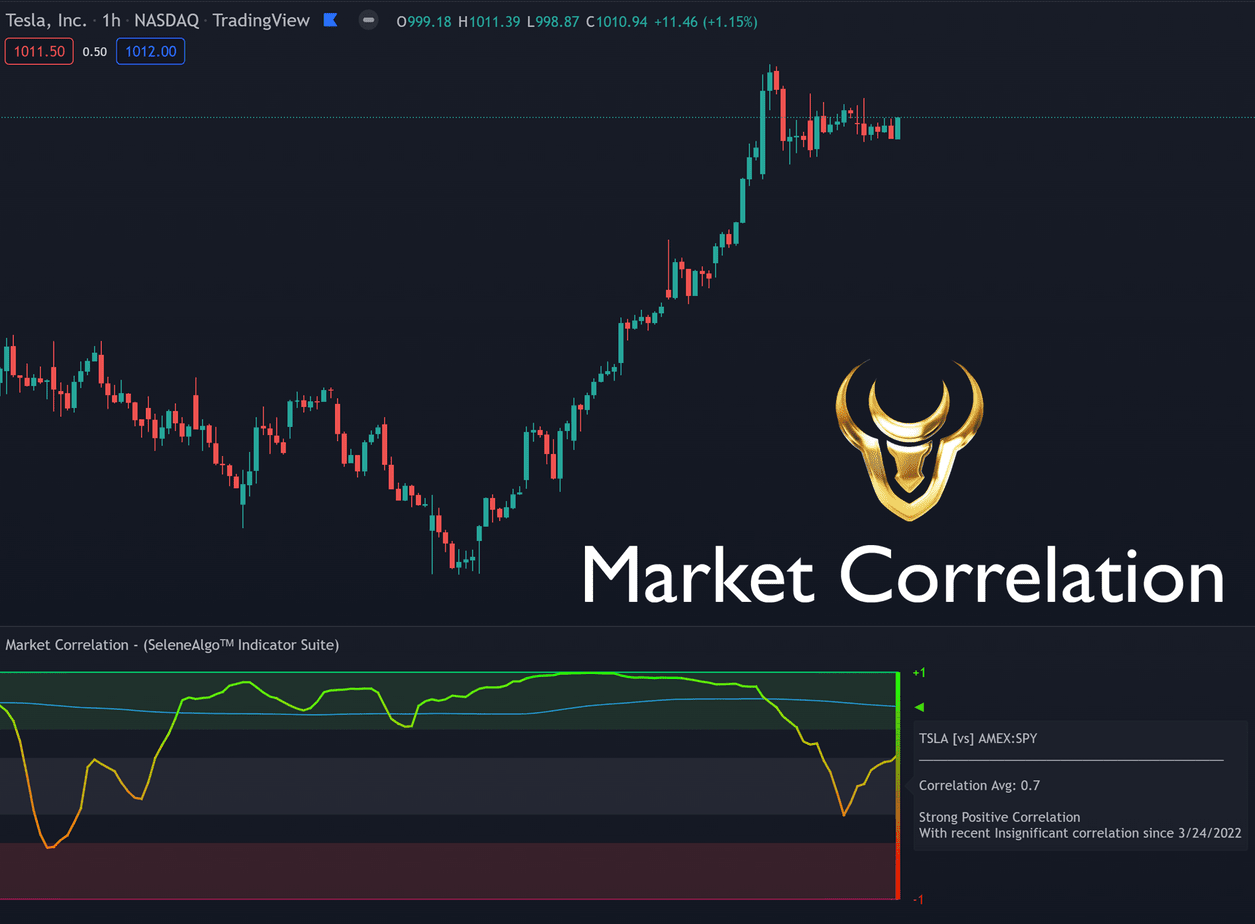

Market Correlation

Market Correlation shows the correlation between multiple securities indicating either a Positive, Negative, or Insignificant Correlation. This can be particularly useful to hedge your trade minimizing risk.

FREE PUBLIC INDICATOR

SeleneAlgo Essentials

Traders often make the mistake of using multiple indicators from the same category/class that are based on the same underlying studies. Doing so can lead to signal duplication creating false confirmations and confidence.

This indicator aims to educate and assist traders to utilize better trade management strategies by highlighting duplicate indicator categories.

This MASSIVE 10 indicators in 1 indicator is available to the public for FREE!

Check out SeleneAlgo Essentials here and just add it as a favorite to get started!