How to Use SeleneAlgo

SeleneAlgo Tips & Strategy

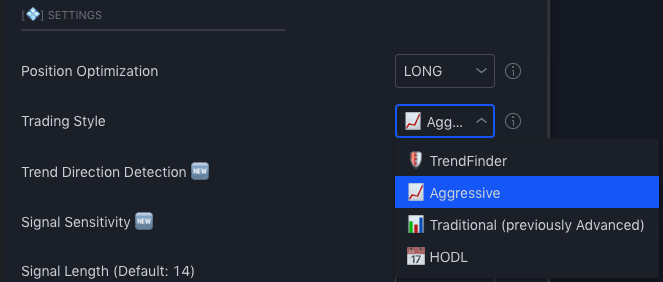

Setting: “Trading Style”

1. Aggressive is works best for most ‘active’ traders when day trading, swing trading, or scalping.

2. TrendFinder works on the same principle as Aggressive, but it will attempt to hold positions longer if a bearish or bullish rally occurs. You can check the Dashboard to confirm the ‘Trend Direction’ is going in the direction you would like. Remember to not trade against the trend.

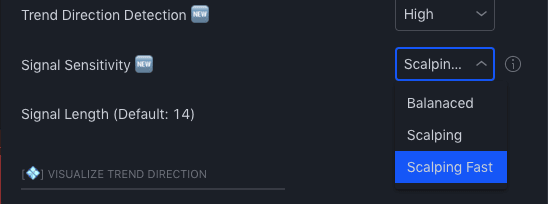

Setting: “Signal Sensitivity”

1. ‘Balanced‘ Signal Sensitivity works very well for most situations traders will encounter. If the Long/Short signals are appearing late on the particular chart/timeframe you are looking at, first make sure your Trading Style is set to Aggressive, then set your Signal Sensitivity to one of the Scalping modes.

2. While ‘Scalping‘ and ‘Scalping Fast‘ can aid in capturing candle direction changes very quickly, they also GREATLY increase the chance of false-positive Long/Short signals.

*Note: Make SURE you confirm your trade decisions with other trading strategies or indicators such as ADX Momentum Insight, Ultimate Support & Resistance, Consolidation Detection, or RSI.

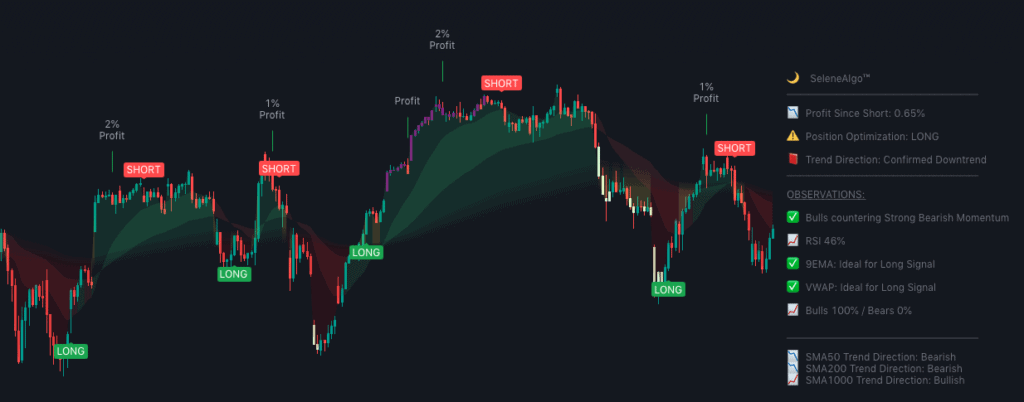

When to Take Profit or Exit

- Take incremental profits whenever you see a ‘Profit‘ signal, and a larger profit when you see the ‘Trailing Take Profit‘ indication on the chart. Trailing Take Profits signals imply the stock is pulling back, and will likely enter a Consolidation period soon. During a Consolidation period, if the price breaks a previous Support level and with an OBV drop, you may want to watch ADX Momentum Indicator carefully to see what its next short term movement will be. If you see too much of a drop in price action, an Exit Long signal, a SHORT signal, or any sort of ‘Downtrend’ status on the Dashboard’s Trend Direction, it’s best to exit your position.

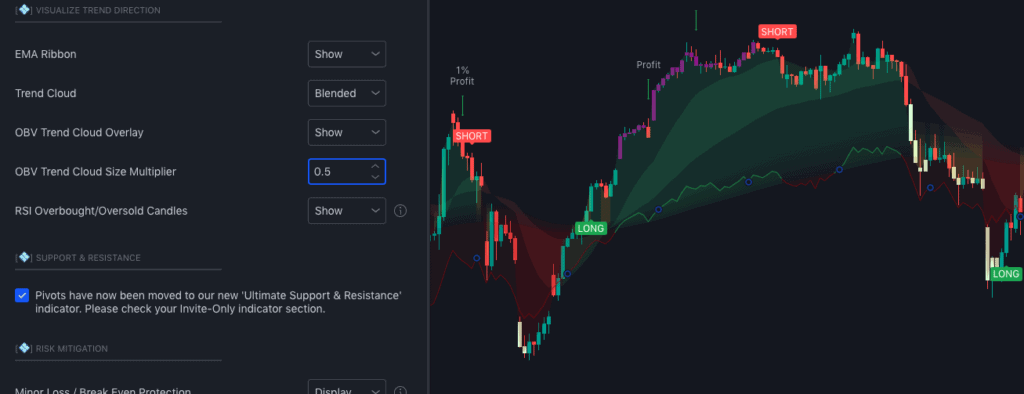

* Optional but helpful: Turn on ‘OBV Trend Cloud Overlay’. Every security is scaled differently so you can tweak the ‘OBV Trend Cloud Size Multiplier’ higher or lower to fit the security/timeframe you are looking at. Ideally you want to adjust the OBV Multiplier until you see the OBV level in between the candles and Trend Cloud edge. If you are taking a Long position, make sure your ‘Position Optimization’ is set to LONG. You will want to make sure the Dashboard’ Trend Direction says either Unconfirmed or Confirmed Uptrend, and that you are seeing both a green Trend Cloud and green OBV.

Supporting Indicators

ADX Momentum Insight

For anything involving Scalping, on ADX Momentum Insight set “Level 2” for the Average Type setting.

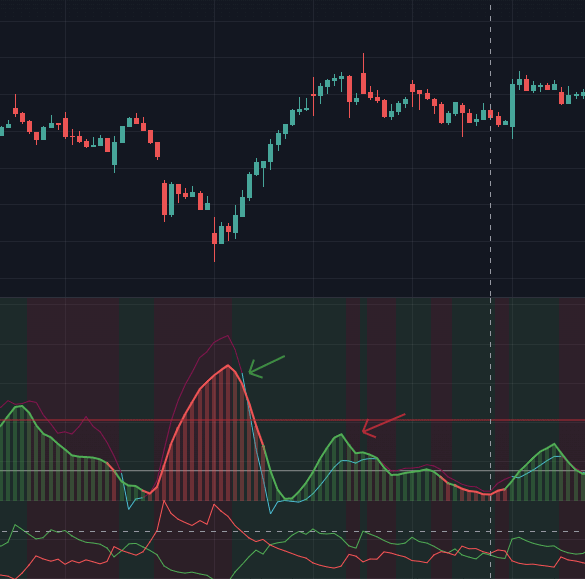

ADX Momentum Insight works REALLY well in conjunction with SeleneAlgo to time your exits perfectly. So generally when you see a high ‘sharp’ peak its a big indicator of a pending reversal.

As a rule of thumb if ADX falls under 15% (the grey horizontal line) it’ll either just continue it’s current direction or go sideways (not reverse), Once it goes over 40 it starts to top out and as soon as it starts to make a ‘peak’, 8 times out of 10 its about to reverse. The higher ADX goes the more volatile and strong the reversal will be.

Something helpful to try is to draw a line around the 40 mark and keep track of when ADX goes above it. You can see in this example when it was above 40 there was a reversal, when it was below 40 (but still above 15) it wasn’t a full reversal but it did stop the trend.

You can find out more about ADX Momentum Insight here: